- Turbotax refund processing service fees for free#

- Turbotax refund processing service fees how to#

- Turbotax refund processing service fees plus#

Turbotax refund processing service fees how to#

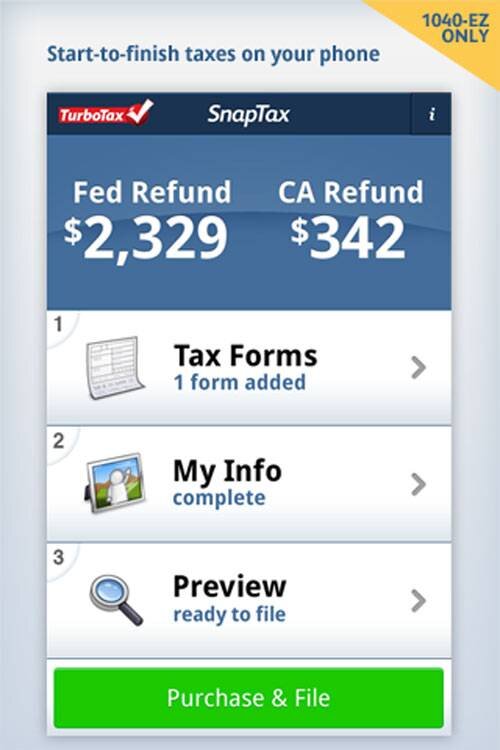

TurboTax gives steps online in an FAQ on how to remove that $39.99 charge. "This is true regardless of whether you are getting a refund or end up owing money." "You don’t pay for TurboTax until you file your taxes," she said. "This is an added convenience offered for those customers who don’t have their credit card handy - and is completely optional. Customers can also choose to pay with a credit, debit or pre-paid card," said Ashley McMahon, senior manager for corporate communications for Intuit, the maker of TurboTax. TurboTax's response to Twitter complaints is that the "Refund Processing Fee ($39.99) is charged by Santa Barbara Tax Product Group, it is not a TurboTax charge." Some consumers call the charge deceptive.Īfter all, pay money to process a refund? Isn't that part of filing your taxes? This tax season, plenty of consumers already have hit Twitter and other social media to complain about a $39.99 charge that's called a "refund processing fee" when they use TurboTax online. More: How to get the best tax deductions if you have kids, home, student loans More: Owe the IRS? Top tax payment questions, answers So before you rush - and you do have until April 17, not April 15 to file this year - watch out for potential tax-time tripwires. Waiting until the last-minute to do your taxes could drive you to sign up for some ridiculous fee or click on the wrong thing. It's an extremely expensive proposition," Wu said. "It's basically a two- to three-week loan. You're essentially taking an advance to cover your tax preparation fee, warned Chi Chi Wu, staff attorney for the National Consumer Law Center. So an $80 bill to do your taxes online easily could turn into $120. But what some consumers don't realize is that there's yet another fee, if you don't pay upfront. The pitch is simple: "Pay nothing out of pocket." How? Well, tax prep firms say you'd deduct what you owe for tax services from your federal income tax refund.

There's usually no service charge to pay via credit card you'll be able to earn rewards points or cash back, depending on the card you have and you'll get your tax refund in full.Watch Video: Getting a big tax refund? That might not be a good thingĬonsumers who want to avoid paying upfront to do their taxes online or get them done at a store front could get tripped up by some unexpected and fairly steep fees. If you can, use a rewards credit card to pay for online tax prep and filing instead of deducting the amount from your refund. But if you want to make the most of your refund, don't settle for the easiest option - take an extra minute to pull out your credit card and avoid the unnecessary processing fee. In fact, they're among the best options on the market. That's not to say these online tax preparers aren't worth your time.

Turbotax refund processing service fees plus#

TaxAct charges its own fee plus bank fees. That's $40 on top of the fee you're paying for the package you selected, meaning you could easily double what you expected to pay. H&R Block and TurboTax each charge an additional processing fee of $40 if you agree to pay through your refund. Paying your online tax preparer through your refund could cost you up to $40 extra Sure, that may sound easy, but be careful: Most preparers tack on an extra fee for this method of payment, and it's not insignificant. If you check the box to pay through your refund, you don't have to do anything on your end but simply wait for your share of the refund to be deposited in your bank account. Online preparers will give you the option to pay for their services via credit or debit card or through your refund. By the time you reach the screen asking for payment, you're probably looking for the quickest exit route. The IRS estimates it takes the average person about four hours to complete and file their return. Most tax preparers don't require money up front you'll typically pay the fees once you're ready to sign and submit your return. If you use an online service like H&R Block, TurboTax, or TaxAct, you can start preparing your return for free.

Turbotax refund processing service fees for free#

Many Americans are eligible for free federal tax filing, but if your income was above $72,000 in 2020 and you have a complex tax situation, you'll likely need to pay tax filing fees to prepare your federal and state returns. About 90% of taxpayers who use this method and are owed a refund get theirs within 21 days of submitting their return.

To receive yours as soon as possible, the IRS recommends filing your tax return electronically and choosing direct deposit. Millions of Americans are looking forward to a tax refund this year.

By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our

0 kommentar(er)

0 kommentar(er)